|

|

Field

|

Description

|

|

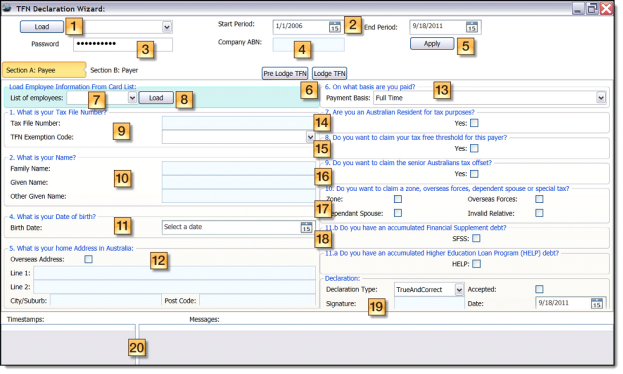

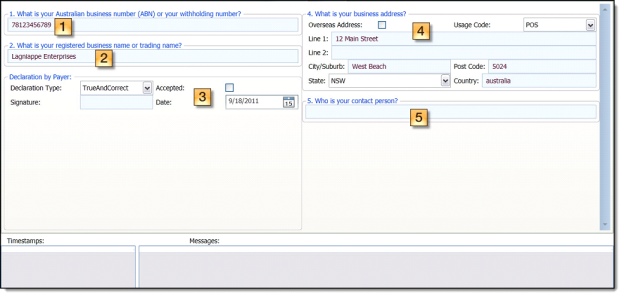

1.

|

Load and TFN List

|

Click the Load button to load an XML file containing your AusKey credentials.

Choose the correct credentials from the TFN List.

|

|

2.

|

Start Period

|

Select or type the appropriate start date for the period from the Start Period dropdown.

|

|

|

End Period

|

Select or type the appropriate end date for the period from the End Period dropdown.

|

|

3.

|

Password

|

Enter your AusKey password for the BAS.

|

|

4.

|

Company ABN

|

Type the appropriate company ABN in the field.

|

|

5.

|

Apply

|

Click Apply to set your username and verify your password.

|

|

6.

|

Pre Lodge TFN

|

Click Pre Lodge TFN to submit the Pre Lodge TFND service.

|

|

|

Lodge TFN

|

Click Lodge TFN to submit the Lodge TFND.

|

|

7.

|

List of Employees

|

Click the List of Employees dropdown to select an employee from the list. This list is created from the card list.

|

|

8.

|

Load

|

Click Load to load the list of employees created from the card list.

|

|

9.

|

What is your tax file number?

|

Type your tax number. Tax numbers are unique numbers issued by the Tax Office to individuals and organisations to identify tax records. It increases efficiencies in administering tax and other Australian Government systems.

If you are unable to report a tax number for an individual, choose the reason from the TFN Exemption dropdown.

|

|

10.

|

What is your Name?

|

Family Name: The payee’s previous surname, where the payee has on the declaration provided a name by which they were previously known to the ATO.

Given Name: The payee’s previous first name, where the payee has on the declaration provided a name by which they were previously known to the ATO.

Other Given Name: The payee’s previous second given name, where the payee has on the declaration provided a name by which they were previously known to the ATO.

|

|

11.

|

What is your Date of birth?

|

Choose the date of birth for the payee.

|

|

12.

|

What is your home Address in Australia?

|

The payee’s home address in Australia. If the payee lives overseas, check the Overseas Address checkbox.

|

|

13.

|

On what basis are you paid?

|

Choose the correct option describing the payment arrangement between the payer and payee.

|

|

14.

|

Are you an Australian resident for tax purposes?

|

If the payee is an Australian resident for tax purposes check the checkbox.

|

|

15.

|

Do you want to claim your tax free threshold for this payer?

|

The tax-free threshold is the amount of income that can be earned each year that is not taxed; this threshold can vary each year. This is only available to Australian residents.

|

|

16.

|

Do you want to claim the senior Australians tax offset?

|

Indicates an offset allowing eligible people to earn more income before they have to pay tax and the Medicare levy has been requested. If a taxpayer is eligible this means they pay less tax. To be eligible a taxpayer must meet four conditions:

1) Age

2) Eligibility for Australian Government age pensions or similar payments

3) Taxable income threshold, and

4) Not in gaol.

If the taxpayer meets all four conditions, the amount of offset will vary depending on their taxable income and circumstances.

|

|

17.

|

Do you want to claim a zone, overseas dependant spouse or special tax?

|

Zone: A Zone offset may be claimed by a taxpayer if they live or work in certain remote areas of Australia.

Overseas Forces: If a taxpayer serves as a member of Australia’s Defence Force or United Nations armed forces, he is eligible for the Overseas Forces tax offset.

Dependant Spouse: The Dependant Spouse Tax Offset is available to taxpayers who contribute to the maintenance of their dependant spouse which reduces the amount of tax to be paid.

Invalid Relative: A person may be entitled to a special tax offset for a dependant invalid relative, dependant parent, housekeeper caring for an invalid spouse or a dependant child-housekeeper.

|

|

18.

|

Do you have accumulated Financial Supplement debt?

|

Check the checkbox if the taxpayer has a Student Financial Supplement Scheme.

|

|

|

Do you have accumulated Higher Education Loan Program (HELP) debt?

|

Check the checkbox if the taxpayer has a Higher Education Loan Program benefit in place.

|

|

19.

|

Declaration

|

Declaration Type: Choose Payee Signature Present if a hardcopy of the reported record has been signed.

Accepted: Check the Accepted checkbox to show that the declaration has been accepted.

Signature: Enter the Supplier Signatory Identifier Text.

Date: Choose the date of the declaration.

|

|

20.

|

Timestamps

Messages

|

If applicable Timestamps and/or Messages will display in this area.

|